The global technology industry in 2024 demonstrated resilience amidst evolving economic and geopolitical challenges.

While economic uncertainties and inflationary pressures persisted, technological innovation continued to drive progress in areas like artificial intelligence, renewable energy, and advanced semiconductors.

Companies worldwide increasingly adopted digital transformation strategies, resulting in a robust demand for cloud computing, automation, and cybersecurity solutions.

However, supply chain disruptions, intensified by geopolitical tensions, impacted production timelines and technology adoption rates in some regions.

Tech hubs like Silicon Valley, Shenzhen, and Bengaluru remained pivotal in shaping the industry's trajectory, but new emerging centers, such as Southeast Asia and Eastern Europe, began to command attention.

Asia solidified its role as a global technology powerhouse in 2024, contributing significantly to advancements in hardware, software, and renewable energy technologies.

Asian economies, led by China, India, South Korea, and Japan, witnessed substantial investment in artificial intelligence, 5G infrastructure, and electric vehicle (EV) ecosystems.

The technology industry in Asia benefited from its diverse ecosystem, which ranges from hardware manufacturing giants to innovative software developers. Governments across the continent rolled out policies to boost local technology development.

For instance, China ramped up its investment in semiconductor self-sufficiency to counteract ongoing trade restrictions, while India introduced incentives for technology start-ups and semiconductor fabrication units.

Asian technology stocks exhibited robust growth, fueled by investor confidence in the region's innovation potential. Notable stock market indices like Japan's Nikkei 200 and China's CSI 300 Index saw gains, largely driven by the performance of leading tech firms. However, challenges such as regulatory pressures and global economic uncertainty posed headwinds.

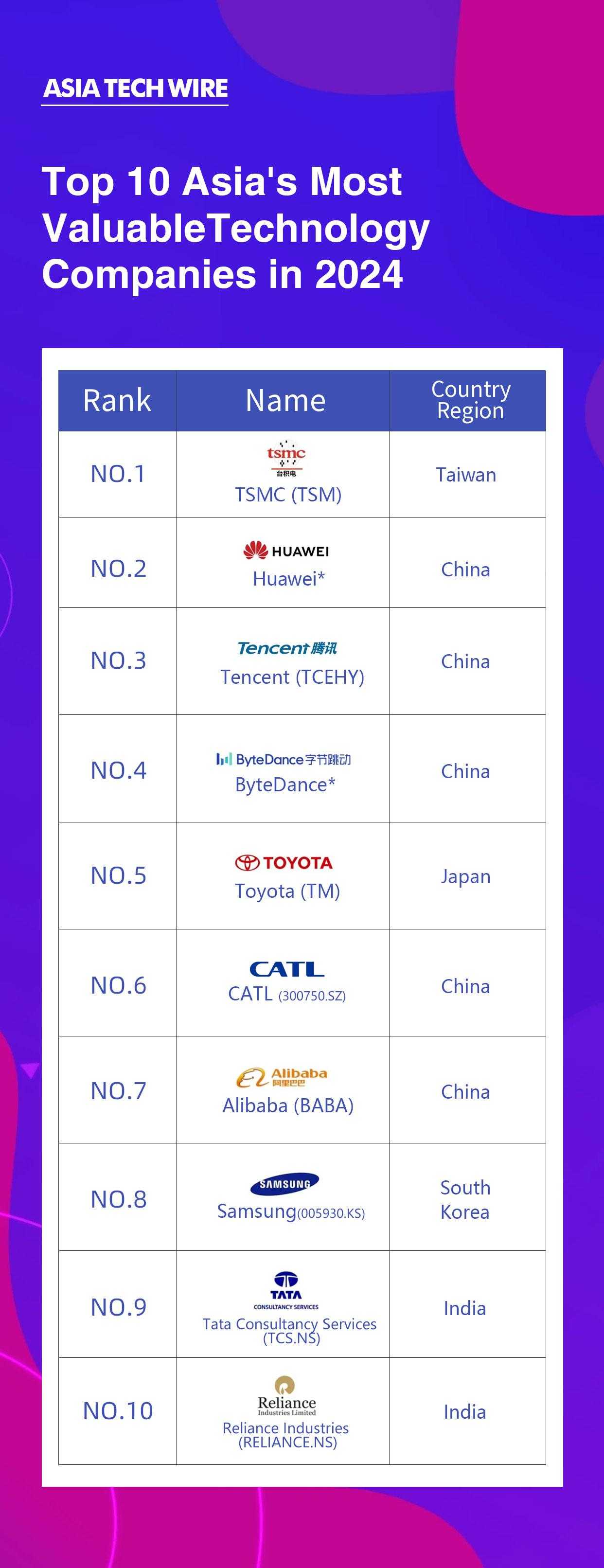

The following is ATW's list of the top 10 most valuable tech companies in Asia in 2024, based on the companies' market capitalization or valuation, and their change in market cap growth.

As you can see, the market cap or valuation of most of these 10 tech companies has risen over the past year, with Huawei's valuation rising the most, about 272%.

In addition, South Korea's Samsung and India's Reliance Industries have both seen their market cap fall over the past year, by 40.13% and 8.96% respectively.

In 2024, TSMC topped the list of Asia's top 10 most valuable tech companies with a market cap of $1.039 trillion. Notably, it is also the only Asian tech company with a market cap exceeding one trillion dollars.

TSMC maintained its position as the world's largest and most advanced semiconductor manufacturer in 2024. Despite fluctuating global demand for semiconductors, the company's investments in 3nm and 5nm process technology have paid off, enabling its customers to deliver cutting-edge products.

And TSMC's semiconductor revenues have grown significantly, driven by strong demand from the artificial intelligence and electric vehicle industries. In the first three quarters of 2024, TSMC amassed revenues of NT$2.02584 trillion.

Considering Bloomberg's forecast of its fourth quarter revenue at NT$861.5 billion, TSMC's full-year 2024 revenue may reach as high as NT$2.88734 trillion, a year-on-year growth of about 33.6%.

Thanks to its technology leadership and strategic partnerships with major global players, TSMC's stock has outperformed its benchmark, with an 81.28% rise in share price for the full year 2024.

Following TSMC is Chinese telecom giant Huawei, whose valuation grew to $476.4 billion from $128 billion at the end of 2023 on the back of strong revenues.

Huawei's strategy of shifting to software and cloud computing continued to bear fruit in 2024, as did the expansion of the company's HarmonyOS ecosystem.

Richard Yu Chengdong, chairman of Huawei's Consumer BG, revealed at a launch event at the end of October last year that HarmonyOS has become the second largest operating system in the Chinese market, with more than 1 billion devices powered by the operating system.

Benefiting from its comprehensive strength in cell phones, automobiles and other businesses, Huawei realized revenue of 585.9 billion yuan and net profit of 63.079 billion yuan in the first three quarters of 2024.

Tencent, which holds the two trump cards of social media and gaming, has seen its market cap grow 37.32% to $492.87 billion over the past year, placing it in third place, the same ranking as in 2023.

In addition to its flagship games "Honor of Kings" and "Game for Peace", Tencent's "Dungeon & Fighter: Origins" (DNF mobile game) , which was launched in May last year, has also made a significant contribution to the stabilized growth of its gaming business.

According to AppMagic estimates, as of December 1, 2024, the cumulative revenue of the DNF mobile game in China's App Store reached $1 billion.

Tencent in 2024 proudly threw away HK$ 112 billion for share buybacks, becoming the "repurchase king" in the Hong Kong stock market this year, and its share price rose 43.7% for the whole year.

TikTok owner ByteDance, whose latest valuation rose to about $300 billion, further rose to fourth place in the rankings.

TikTok, which has 170 million users in the U.S., is facing a major threat in the U.S., where a "sell or ban" law is set to take effect on January 19th.

U.S. President-elect Donald Trump requested a suspension of the TikTok ban, but the U.S. Department of Justice rejected the request in a letter to the Supreme Court on the evening of January 3rd.

As TikTok's fate is uncertain, ByteDance is betting heavily on artificial intelligence. A brokerage report at the end of last month indicated that its AI investment is as high as 80 billion yuan in 2024, and is expected to reach 160 billion yuan in 2025.

Japan's Toyota, which has accelerated its commitment to electrification and self-driving technology in 2024, has also seen its market cap grow 5.57% over the past year to $261.25 billion.

The company has launched several electric car models and expanded its hydrogen fuel cell vehicle program, and partnerships with tech companies on software and artificial intelligence solutions have bolstered its competitive advantage.

Notably, CATL, which did not make the top 10 list in 2023, increased its market cap by 58.6% to $160.48 billion in 2024, placing it in sixth place.

As the world's leading electric vehicle battery supplier, CATL has continued its efforts in solid-state battery technology, cooperating with companies such as Lead Intelligent Equipment in the field.

CATL, which has been listed in Shenzhen in 2018, is looking to go for a second listing in Hong Kong, reportedly likely to raise at least $5 billion.

Alibaba's market cap grew just 1.34% to $201.22 billion over the past year, so it trails CATL by one spot to seventh place.

The e-commerce giant officially completed a three-year overhaul at the end of August last year after being fined 18.228 billion yuan in 2021 for antitrust practices and required to rectify the situation.

In 2024, Alibaba's attempts to rekindle growth momentum in its two core businesses, e-commerce and cloud computing, paid off.

In particular, Alibaba's fiscal 2025 second-quarter results, which ended Sept. 30, showed revenue from its cloud computing unit rose 7% year-on-year to 29.61 billion yuan.

South Korea's Samsung has seen its market cap fall 40.13% over the past year, ending the year in eighth place with a market cap of just $240.42 billion.

Samsung's management made a rare apology at the end of October last year after reporting third-quarter results that fell short of market expectations, for failing to capitalize on the profit opportunities presented by the AI boom.

Samsung lags behind rival SK hynix in the field of memory chips used for AI development and paired with Nvidia processors. And in chip foundry, it still has a big gap with TSMC.

India's Tata Consultancy Services (TCS) and Reliance Industries, ranked ninth and 10th, have market capitalizations of $171.89 billion and $191.45 billion at the end of 2024, respectively.

TCS flourished in 2024, driven by strong demand for digital transformation services. Its artificial intelligence and machine learning solutions have gained traction with clients globally, especially in the financial services and healthcare sectors.

Reliance Industries' technology and telecom business continues to grow in 2024, as its Reliance Jio, India's largest telecom operator, has begun selling its indigenous homegrown 5G stack technology in international markets.

Overall, the companies on the list in 2024 still haven't changed much compared to 2023, except for CATL, which replaced Chinese e-commerce giant Pinduoduo in the top ten.

In terms of market cap, Pinduoduo grew 88.52% in 2023 but fell 32.56% in 2024, shrinking from $194.38 billion to $131.08 billion.

Due to the fierce competition in China's e-commerce industry and many uncertainties in overseas markets, the Q2 and Q3 revenues of 2024 Pinduoduo previously disclosed fell short of expectations.

The less-than-expected results have led to drops in the stock price, which will obviously cause huge losses to hedge funds with long positions in Pinduoduo.

According to Reuters calculations, Pinduoduo's shares fell 30% between the end of June and August 29 last year. Based on the positions disclosed at the time, global hedge funds such as Appaloosa Management could have lost as much as $4 billion during that period.