Image by mohamed Hassan from Pixabay

Image by mohamed Hassan from Pixabay

(Asian Tech Press) After a seven-year hiatus, China has once again stepped up its crackdown on cryptocurrency trading.

Following the shutdown of bitcoin miners, the state-owned Agricultural Bank of China (ABC) issued a notice banning the use of its services for virtual currency transactions such as bitcoin.

Such a notice is reminiscent of a notice issued seven years ago by the People's Bank of China (PBOC), China's central bank, that caused Bitcoin price to fall by up to 25%.

ABC announced on Monday that it is determined not to carry out or participate in any business activities related to virtual currencies, to prohibit access to customers involved in virtual currency transactions, and will increase its efforts to investigate and monitor customers and financial transactions.

The announccement on ABC's Chinese official website

The announccement on ABC's Chinese official website

The state-owned bank said it will immediately take measures such as suspending account transactions and terminating customer relationships once related behaviors are discovered, and will promptly report to relevant authorities.

In the notice, ABC, the world's third-largest bank, emphasized that these actions were in the strict implementation of the country's regulatory requirements for cracking down virtual currency transactions.

Before the release by ABC, the PBOC interviewed major lenders and payment firms, including the Industrial and Commercial Bank of China (ICBC), ABC, China Construction Bank (CCB), and Alipay, urging them not to provide crypto-related services.

But surprisingly, ABC's statement soon disappeared from its official website.

Following ABC's statement, the top 2 largest banks in the world, ICBC and CCB released similar statements one after another. According to the usual practice, it is expected that all Chinese banks will issue relevant bans.

In a dramatic turn of events, a few hours later, the once-disappearing statement from ABC was reinstated on its official website.

China has intensified its crackdown on cryptocurrencies. A number of senior figures in the Chinese banking industry have also spoken out around bitcoin.

In a recent public speech, Wang Yongli, former vice governor of the state-owned Bank of China (BOC), claimed that investors can hold bitcoin, but don't rely on it to make money. He also pointed out that it is almost always a pipe dream to think beyond a sovereign currency before the world has achieved integrated governance.

Chinese regulators have also launched a massive crackdown on bitcoin mining. Last week, Sichuan, China's second-biggest bitcoin mining province, ordered to immediately stop supplying electricity to crypto-mining projects. On this, Chinese media commented that it was the end of an era.

In fact, it was in 2014 that Beijing issued its last regulatory ban on bitcoin transactions.

According to a report by Hong Kong media outlet Finance Press on March 21, 2014, China's central bank asked commercial banks to ban services for bitcoin transactions.

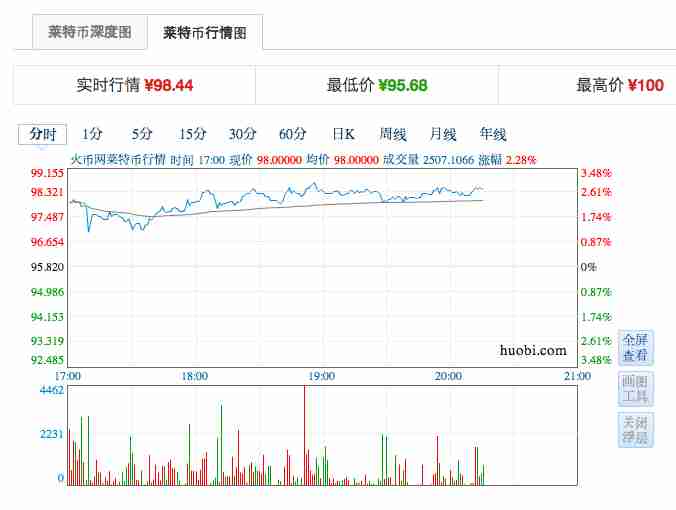

The news triggered dramatic shocks in the virtual currency market. Bitcoin fell by more than 10% or even up to 25% on major crypto-trading platforms. Litecoin (LTC) price dropped sharply from nearly 100 yuan to 1 yuan at one point on the Chinese crypto exchange Huobi, causing Litecoin buyers to fail to react in time and to suffer heavy losses.

LTC prices on March 21, 2014 from Huobi.com

LTC prices on March 21, 2014 from Huobi.com

It wasn't until that night that China's central bank clarified the rumors on Chinese Twitter-like Weibo, saying that there was no ban requiring a halt to bitcoin transactions, and re-emphasizing the relevant content of the five ministries' documents released last December, reaffirming the commodity properties of virtual currencies such as bitcoin.

At this point, the prices of Bitcoin and Litecoin have only slowly returned to normal levels in China's crypto trading market.

But that news was not unfounded. In retrospect, it may have been a deliberate release from China's central bank to the Hong Kong media. Two weeks later, Caixin, an official media outlet in mainland China, confirmed the authenticity of the central bank's regulatory policy.

After 7 years, China's financial regulator has once again asked commercial banks to stop providing virtual currency trading and related services. Whether it is a short-term policy or a permanent ban, global investors can only wait and see.