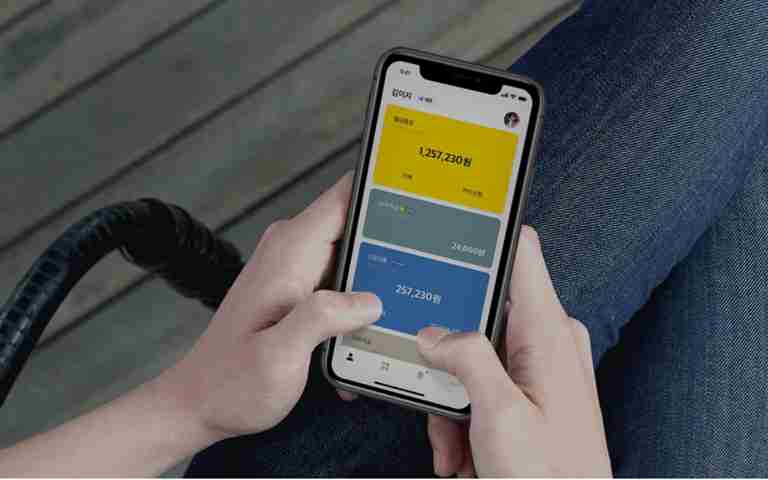

Image from KakaoBank's website

Image from KakaoBank's website

KakaoBank Corp., the internet-only lender backed by South Korea’s Kakao Corp., is planning to raise as much as $2.3 billion in an initial public offering, joining a rush by the nation’s companies to sell shares.

The bank is selling 65.45 million new shares at between 33,000 won and 39,000 won apiece, according to a filing Monday. At the top end of the range, the company would raise 2.55 trillion won and have a market capitalization of more than $16 billion, based on the total outstanding stock after the debut.

The listing could make Kakao Bank the third most valuable lender in Korea, after KB Financial Group Inc. and Shinhan Financial Group Co.

It’s the latest listing by South Korean corporates, following the debut of online retailer Coupang Inc. in New York as well as a proposed float by Krafton Inc. Kakao, which has been pushing for listings of its affiliates, listed Kakao Games last September, while Kakao Pay is also planning an IPO this year. Kakao Mobility and Kakao Entertainment are also considering listings.

Kakao Bank was formed in 2016 after the Korean government offered online-banking permits for the first time in 2015. The bank has benefited from its parent company’s Kakao Talk, the nation’s largest mobile messenger service with 46 million active users out of a population of about 51 million.

Kakao Banks’ advisors based their pricing estimates on comparisons with Rocket Cos Inc. -- the operator of Quicken Loans, worth about $40 billion -- as well as online finance firms like TCS Group Holding Plc and Nordnet AB, according to the Korean company. The trio, along with Brazilian firm Pagseguro Digital Ltd. trade at about 5 to 9 times book value.

The lender is seeking to go public just as competition in the online-banking sector heats up. Viva Republica Inc. plans to launch Toss Bank as early as September after receiving South Korea’s third internet banking license while K Bank, which has amassed new users in the crypto space, recently sought 1.2 trillion won from shareholders including Bain Capital to grow its business.

Subscription for the IPO will take place over two days starting from July 26, followed by its debut on Aug. 5. KB Securities Co. and Credit Suisse Group AG are the lead arrangers for the offer.

Source: https://www.bloomberg.com/news/articles/2021-06-28/south-korea-s-kakao-bank-seeks-as-much-as-2-3-billion-in-ipo