US capital groups increase their holdings in Chinese tourism and real estate companies

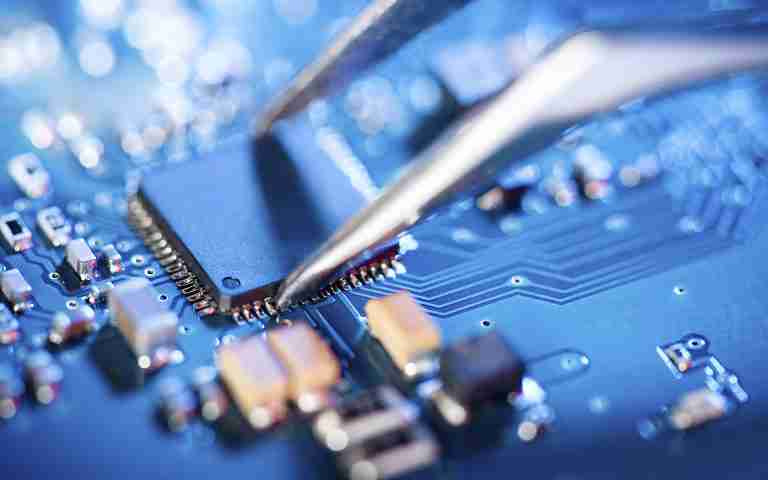

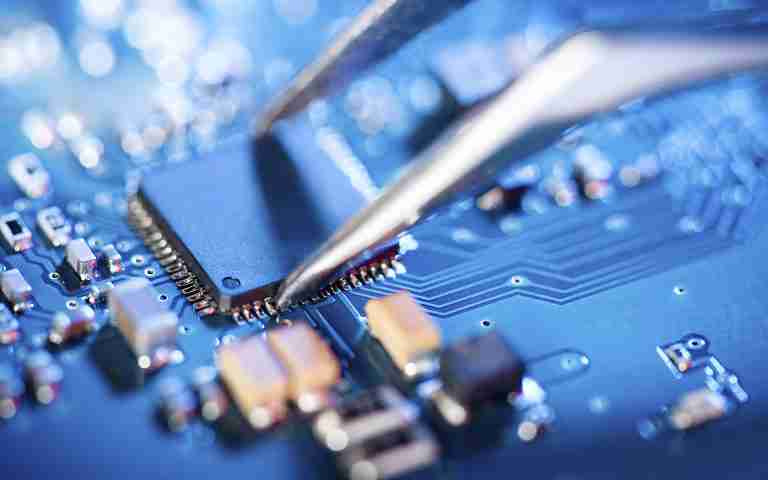

According to information from the Hong Kong Stock Exchange's disclosure system, recently, the trillion-dollar asset management giant Capital Group has increased its holdings in Chinese tourism companies and real estate companies, betting on investment opportunities brought by a further rebound in the economy. In addition, Capital Group's first Asian flagship fund has a heavy position in Chinese Internet companies. China is the fund's largest market. Since October, Capital Group has increased its holdings in Huazhu Group. Since November, Capital Group has increased its holdings in Poly Property several times. In December, Capital Group also increased its holdings in Hong Kong-listed semiconductor leader ASM Pacific Technology Co., Ltd. Since October, Capital Group has also adjusted some of its holdings, reducing its holdings in Zai Lab, BeiGene, China Duty Free Group and other stocks. According to data, Capital Group is headquartered in Los Angeles, USA, and its latest management scale is about US$2.7 trillion. It has a history of 93 years and is best known for its long-term investment philosophy and investment model of co-management by multiple fund managers.