The A-share M&A and restructuring market continues to grow in activity

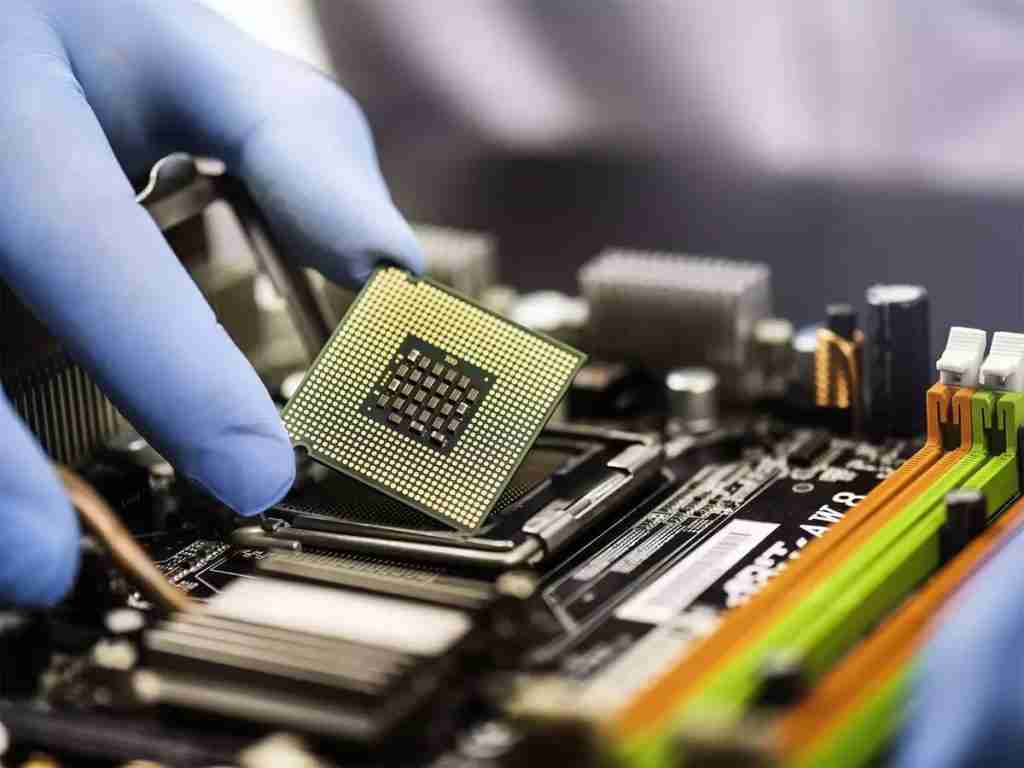

The activity of the A-share merger and reorganization market continues to increase. Recently, Haiguang Information, a listed company in the semiconductor industry, exchanged shares to absorb and merge Sugon, which attracted market attention. According to incomplete statistics from a reporter from China Securities Journal, since the beginning of this year, more than 10 listed companies in the semiconductor and chip industries, including Shanghai Silicon Industry, Wingtech Technology, Guokewei, Jingfeng Mingyuan, YUYUAN Silicon, and Yingjixin, have issued announcements related to mergers and acquisitions. Driven by the support of merger and acquisition policies and the recovery of the semiconductor market, the semiconductor industry has ushered in a new wave of mergers and acquisitions. In addition, recently, the mergers and acquisitions of many central enterprises have made new progress, which has attracted market attention. Regarding the hot tracks for mergers and acquisitions in the future, industry insiders generally believe that the hot areas of A-share mergers and acquisitions may be concentrated in emerging fields such as new energy, semiconductors, and biomedicine. These fields have high growth and market potential, and also require a lot of financial and technical support, so they have become hot areas for mergers and acquisitions.

![]()